Donor Advised Funds - One Solution for Charitable Giving

Someone asked me about how a Donor Advised Fund (DAF) works. The individual had recently sold their business and had heard of this vehicle as a way to amplify their charitable giving in light of their current year sale of business gain.

The IRS starts with a surprisingly simple description on their website (https://www.irs.gov/charities-non-profits/charitable-organizations/donor-advised-funds). “Generally, a donor advised fund is a separately identified fund or account that is maintained and operated by a section 501 (c)(3) organization, which is called a sponsoring organization. Each account is composed of contributions made by individual donors. Once the donor makes the contribution, the organization has legal control over it. However, the donor, or the donor’s representative, retains advisory privileges with respect to the distribution of funds and the investment of assets in the account.”

Why not either set up a Charitable Foundation or just write checks directly to charities you might ask? It seems to me that DAFs provide charitable Foundation style advantages with the ease or simplicity of writing checks. Here’s why I say that:

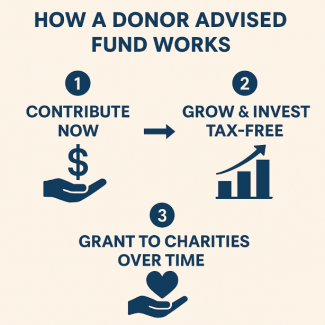

- Like using a Foundation, a donor can make a large contribution and take a tax deduction now for the current value of the contributed assets even though actual disbursements to one or more charities will take place over time.

- And, like a Foundation, the donor ultimately chooses which charities receive the donation and when. In the meantime, funds or other assets in the DAF can appreciate tax-free, which levers up the overall amount the charities receive.

- Unlike a Foundation there are little, or no costly setup fees, no annual investment tax obligations, and ongoing administrative costs are contractually determined. Once established the sponsoring organization handles all the bookkeeping, tax and other filings.

- And, unlike a Foundation there is no requirement to distribute a certain percentage to charities each year. The funds can remain invested in your DAF account for years.

TAX TIP: Donor Advised Funds may get a current year boost from the One Big Beautiful Bill Act (OBBA) passed earlier this year. That is because, while the OBBA has made permanent the 37% top tier tax bracket for individuals it places a cap on the tax benefit of itemized charitable contributions of 35%. Accelerating planned 2026 and beyond contributions into 2025 would be advantageous for those in the 37% bracket.

Finally, a word of caution. Donor Advised Funds are not for everyone, nor every charitable or legacy strategy. I’ve covered some highlights but, no surprise, IRS regulations covering individual gifting, Donor Advised Funds and Charitable Foundations are complex.

Because an individual’s specific facts and circumstances have not been considered herein, this is not intended to be used as tax advice. Please consult a tax professional for specific information and advice. Accordingly, if you have a question regarding this topic, feel free to email me at gclarke@uswealthclarke.com.