Fee-Based Financial Planning and Wealth Management: Putting You First

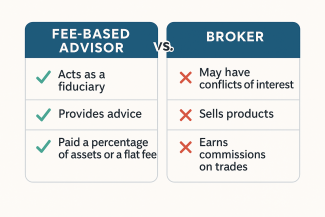

At an Economic Briefing last week I was asked which Broker-Dealer I was affiliated with. I explained that my securities license was that of an Investment Advisor Representative (IAR) and as such I was not affiliated with a Broker-Dealer firm. Those working for Broker-Dealers (Brokers) are salespeople in the business of buying and selling stocks, bonds and other investments on behalf of their customers and they charge a commission on each transaction they process. Investment Advisor Representatives provide advice about financial securities, manage investment portfolios and offer financial planning services for a fee.

Investment Advisor Representatives are fee-based fiduciaries, who do not earn commissions for buying and selling investment products. As fiduciaries we have both a duty of care and a duty of loyalty to our clients. We believe that when it comes to managing a client’s life savings, transparency and trust matter. As a result, Investment Advisers sit on their client’s side of the table, providing advice that aligns with the client’s goals not someone else’s sales quota.

One way to think of it is you wouldn’t want your physician prescribing treatments based on incentives. The same logic applies to your finances. We believe that whether you’re planning for retirement, managing an inheritance, business sale proceeds or a divorce settlement, a fee-based approach ensures that your interests always come first.